- In the first half of 2023, grain from Ukraine exceeded 296,000 tonnes, already exceeding the total data for 2022.

- In the first six months of this year, Ukraine leads the imports of cereal arriving at the Port of Valencia ahead of Romania.

- The recent attacks by Russia – after withdrawing from the Black Sea agreement – on cereal warehouses in Ukraine will once again limit exports from the breadbasket of Europe.

- In 2022, the first year of the war, Ukrainian grain arriving in Valencia was 241,000 tonnes, the lowest figure in five years. The blockade of Ukrainian ports in the Black Sea has concentrated imports in a few very specific months.

- Total imports of cereals and their flours arriving at Valenciaport in 2022 were 1,317,074 tonnes compared to 1,066,434 tonnes in 2021, an increase of 23.5%.

- Of these, 18.3% came from Ukraine, while in 2021 this percentage was 30.8%. In 2018, 59% of the grain arriving at the Port of Valencia originated in the Ukrainian region. In 2019, it was 52% and in 2020 (Covid year) it was 35.4%.

- In the last two years, Romania has overtaken the Ukrainian country in the import of maize or wheat to the Valencian precinct. Brazil has also increased its import weight of these cereals in the last year.

The Ukrainian war generated by Russia’s invasion put many countries in check on a crucial food issue: cereals. The ‘breadbasket of Europe’ was invaded and its grain exports were put on standby. According to the World Factbook, an annual publication of the US Central Intelligence Agency, Ukraine is the largest country in Europe in terms of arable land, accounting for 56.1 per cent of its land area. A key region for supplying grain to Europe, but also to other countries outside the European Union that are highly dependent on Ukrainian grain.

A European Union (EU) report noted that “since the start of the Russian invasion of Ukraine in February 2022, Ukrainian grain exports have been severely disrupted. For more than four months, Russian military vessels have blockaded Ukrainian Black Sea ports”. This situation has led to a rise in the price of this raw material, which affects many countries. This rise in value was also felt in Spain, although there were no problems of shortages.

A European Union (EU) report noted that “since the start of the Russian invasion of Ukraine in February 2022, Ukrainian grain exports have been severely disrupted. For more than four months, Russian military vessels have blockaded Ukrainian Black Sea ports”. This situation has led to a rise in the price of this raw material, which affects many countries. This rise in value was also felt in Spain, although there were no problems of shortages.

The Port of Valencia is one of the destinations where the grain arrives from the Baltic country for consumption in our country. The war paralysed a large part of imports, although the “windows” to maritime trade negotiated by the United Nations partially alleviated the drop in Ukrainian grain arriving on Valencian coasts. In 2022, the figure stood at 241,000 tonnes, 87,000 less than the previous year, and the lowest figure in recent years. In the first quarter of this year, there are already 163,000 tonnes, a positive figure pending the evolution of the conflict situation due to the Russian invasion. Maize, wheat, barley and sunflower derivatives are the cereals most affected by the war in Ukraine. This situation has led to an increase in imports from other countries such as Romania and, in the case of last year, Brazil.

The same EU report indicates that “on 22 July 2022, the United Nations and Turkey negotiated an agreement for the opening of a safe maritime humanitarian corridor in the Black Sea. Since then, some 800 ships full of grain and other foodstuffs have left three Ukrainian ports: Chornomorsk, Odessa and Yuzhny/Pivdennyi. While unblocking the sea export route has helped to address the global food security crisis and reduce grain prices, export delays remain significant. By March 2023, more than 23 million tonnes of grains and other foodstuffs have been exported under the Black Sea Grain Export Initiative”.

The flow of cereal originating from the Ukrainian country depends on the agreements reached by the different countries and Russia’s threats on the international agreements that provide an outlet for the cereal that leaves Europe’s granary for the whole world. In fact, in this first half of 2023, the grain from Ukraine that has arrived at the Port of Valencia has exceeded 296,000 tonnes, already above the figures for the whole of 2022. A situation which, following Russia’s non-renewal of the agreement that allowed shipments from Ukrainian ports through the Black Sea and the attack on Ukraine’s cereal infrastructures, once again puts the supply of these basic products from the breadbasket of Europe to the rest of the world, especially to the country’s most in need, at serious risk.

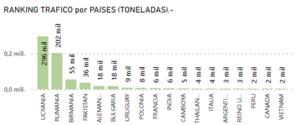

Cereal imports data for the first half of 2023. Source APV

Cereal arriving at the Port of Valencia

Within this framework, during 2022, the import of cereals from the Ukraine to the Port of Valencia reached 241,000 tonnes which were concentrated in the months of February (65,000), March (83,000), November (65,000) and December (29,000). In 2021, 328 tonnes of Ukrainian grain arrived at the Valencian docks with ships arriving in ten of the months of the year. In 2019, the pre-covid year, imports amounted to 616 tonnes, also spread over ten months, while in 2018 there were 850,000 tonnes. The import/export of this type of product varies depending on the harvests produced in the countries and their storage.

In percentage terms, 18.3% of the total cereals and their flours arriving at the Port of Valencia came from Ukraine, while in 2021 this percentage was 30.8%. In 2018, 59% of the cereal arriving at the Port of Valencia originated in the Ukrainian region. In 2019, it was 52% and in 2020 (Covid year) it was 35.4%.

If we analyse 2022, the year of the Russian invasion, in comparison with 2021, the data show a difference between the period before the war of a positive balance of 87,000 tonnes more than in 2022 of Ukrainian cereal. And if we compare it with a pre-Covid year, the differences are even greater. In 2019, the cereal imported from Ukraine was 375,000 tonnes more than in 2022, and in 2018 the difference is more than 600,000 tonnes.

Countries taking over

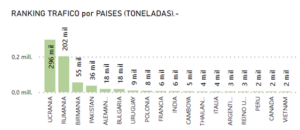

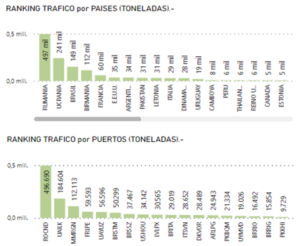

Romania is in dispute with the Ukrainian region over grain imports. In the last two full years (2022 and 2021), the arrival of grain from the Eastern Carpathian country, mainly from the port of Constanta, was 497,000 tonnes and 426,000 tonnes, respectively. Placing it in first place above Ukraine which led this position in 2018, 2019 and 2020. In this regard, it should be noted that since the war, part of the Ukrainian grain has been leaving the country by land or sea via the Danube to Romania for export from there.

Also noteworthy is Brazil’s position in 2022 as the third country that imported the most grain, especially maize, through the Port of Valencia, when in previous years its figures were not very significant. According to the Brazilian National Supply Company (Conab), between January and September 2022, the South American country increased its volume of maize exports by 92.3%.

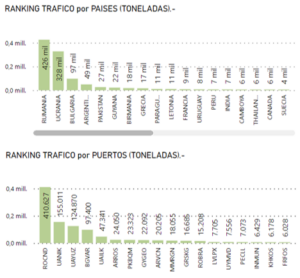

With regard to the first six months of 2023, Ukraine once again leads the ranking with 296,000 tonnes, concentrated in the months of January (84,000 tonnes), March (79,000 tonnes), May (100,000 tonnes) and June (33,000 tonnes). In total, between January and June 2023, imports of cereals and their flours to the Port of Valencia amounted to 683,000 tonnes, with Ukrainian grain accounting for 30% of the total. In second place is Romania with 202,000 tonnes.

Ukrainian ports

Looking at the main Ukrainian ports, in 2022 74% of imports came from Chornomorsk, 23% from Yuzhny, 2% from Nikolaev and 1% from Odessa. In 2021, 43% came from Nikolaev, 38% from Yuzhny, 13% from Chornomorsk; 2.5% from Maripol; 2% from Odessa; 1% from Kherson; and 0.5% from Izmail Port on the Danube. In 2019, 36% of imports came from the Chornomorsk precinct; 21% from Yuznhy; 20% from Nikolaev; 19% from Odessa; and the remaining 4% from the ports of Maripol, Izmail and Reni.

In the first half of 2023, 2 out of 3 tonnes will come from the port of Yuznhy in the north of the Odessa region, while 17% will come to Chornomorsk in the south of Odessa, and the same percentage from the port of the iconic Ukrainian World Heritage city itself.

Imports Cereals and their flours 2022. Source Foreland 4.0. APV

Imports Cereals and their flours 2021. Source Foreland 4.0. APV

Data 2023